Sales wise, the auto industry had a phenomenal 2016. On the contrary, impressive sales have put dealership-automaker relationships on edge, and in turn, regulators are becoming more stringent on car dealerships’ overall processes.

In the wake of the VW scandal, it is apparent that manufacturers and dealerships alike are equally unprepared when it comes to compliance. As the auto industry looks to have another impactful year ahead, now is the time for car dealerships to pay attention to compliance and ensure everything is in order.

Earlier this year, The Department of Labor adjusted its penalties for its agencies, including the Occupational Safety and Health Administration (OSHA). Section 701 of the Bipartisan Budget Act of 2015 contained the Federal Civil Penalties Inflation Adjustment Improvements Act of 2015, which required OSHA to implement inflation-adjusted civil penalty increases. The Inflation Adjustment Act also allowed OSHA a one time "catch-up adjustment" to adjust for inflation since 1990 (the last time penalties were adjusted) along with annual adjustments for inflation based on the Consumer Price Index.

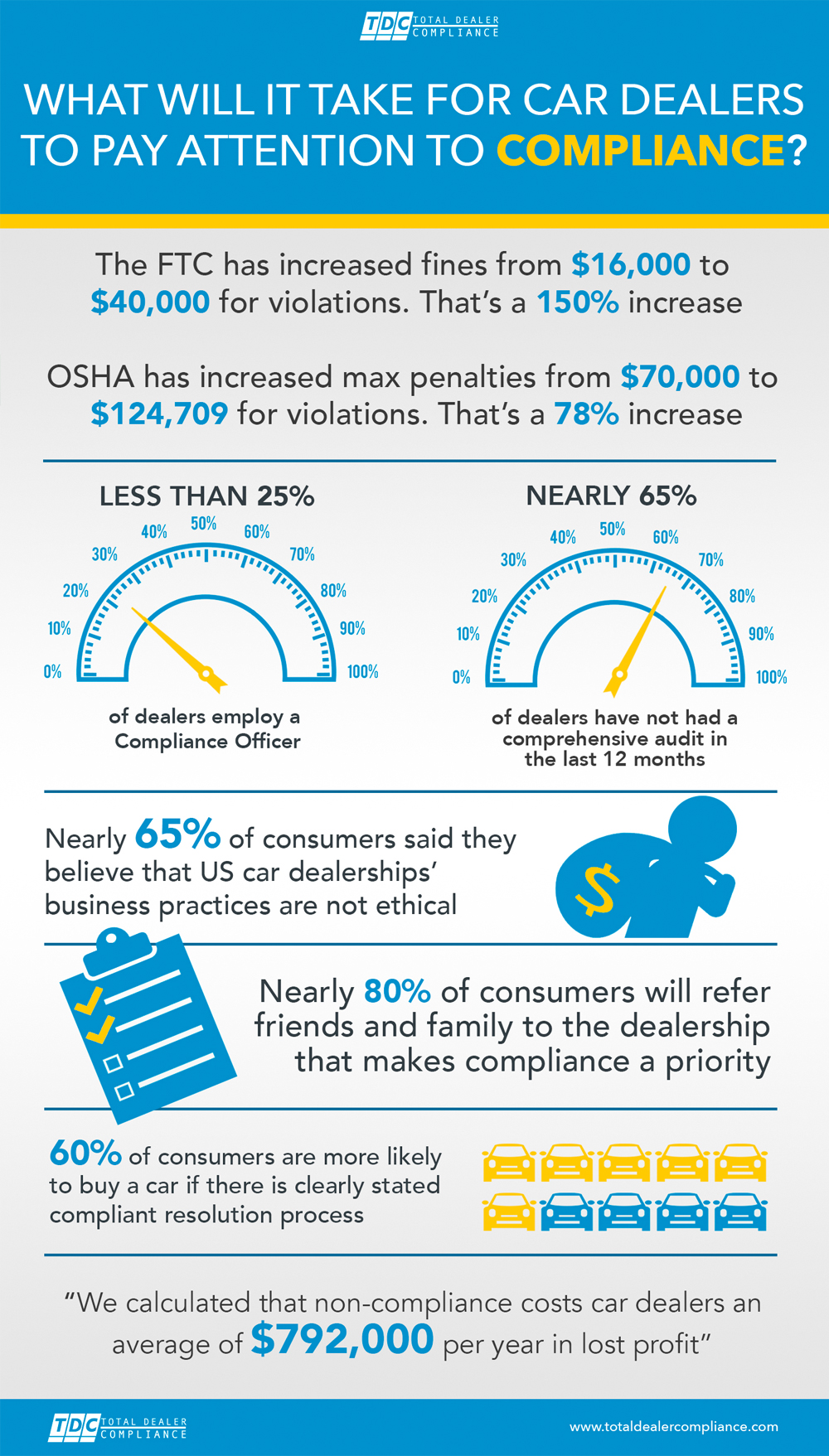

What does this mean for car dealers? Federal regulators are on the prowl even more so to catch car dealerships who fail to run compliant operations, and car dealers are often viewed as easy targets. The new penalties took effect August 2nd of this year and the max fine for non-compliance jumped from $70,000 to $124,709, while $16,000 to $40,000, while The Federal Trade Commission has increased penalties.

The reality of these increases is alarming considering OSHA typically cites a business with more than one violation. As penalties increase in magnitude, it is increasingly important for car dealerships to find experienced experts that can first and foremost help them to safeguard their operations and auto practices.

Those figures alone should be enough to make compliance a priority for your dealership in 2017. But it’s not just the financial implications. Customers also feel more comfortable doing business with a dealership that adheres to all federal regulations. 60% of consumers are more likely to buy a car if there is clearly stated compliant resolution process while nearly 80% of consumers will refer friends and family to the dealership that makes compliance a priority.

But less than 25% of dealers employ a Compliance Officer and 65% of dealers have not had a

comprehensive audit in the last 12 months.

An auto dealership survey conducted online in July explored the public’s perception of a car dealership’s adherence to a code of ethics. Upon examining the survey results, nearly 65% of consumers said they believe that US car dealerships’ business practices are not ethical. While over 50% of consumers are more likely to shop at a dealership if their code of ethics were clearly displayed when shopping.

Compliance is straightforward but it starts at the top. Proactive steps taken by the dealer’s leadership team can ensure that the entire operation is fully compliant across all departments. The first of those steps is to adopt a well-designed compliance program that applies equally to all departments so everyone who works for you knows they will be held accountable to the same standards whether they work in Sales, BDC, F&I, Fixed Ops, HR or IT. It will also send a message to junior staff that the entire organization is fully committed.

With non-compliance costing car dealers’ an average of $792,000 per year in lost profit, this reinforces how critical it is to run a business known as reputable and trustworthy as we head into 2017. The impact on your bottom line is undeniable. Today, more than ever before, customers are demanding a fully transparent sales process that makes them feel good about where they spend their hard-earned money.